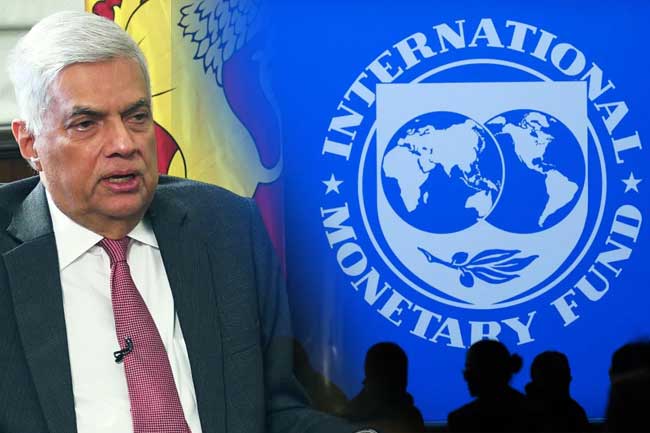

Today, President Ranil Wickremesinghe is set to have his final meeting with the International Monetary Fund (IMF) team, concluding a series of meetings that began on September 14th to review the Extended Fund Facility (EFF) program.

Following this meeting, an agreement for the second allocation of the IMF’s bailout package will be signed. The initial meeting for the IMF’s first EFF review in Sri Lanka took place on September 14th in Colombo, with notable representatives from the Sri Lankan government, namely Finance State Minister Shehan Semasinghe, President’s Senior Adviser on National Security and Chief of Staff Sagala Ratnayaka, President’s Secretary Saman Ekanayake, Advisor to the President on Economic Affairs Dr. R.H.S. Samaratunga, Finance Ministry Secretary Mahinda Siriwardana and Central Bank Governor Dr. Nandalal Weerasinghe. Representing the IMF delegation at the meeting were Senior Mission Chief Peter Breuer, Deputy Mission Chief Katya Svirydzenka, Mike Li, Sophia Zhang, Dmitriy Rozhkov, Noda Selim, Sandesh Dhungana, Nui Miao, Mark Adams (virtual), Joei Turkewitz, and Nuong Lan Vu.

During this review process, Sri Lanka’s objective was to convince IMF officials that it has met the key goals of the bailout program, which are essential for its economic recovery, particularly in terms of debt restructuring.

Successfully completing the first IMF review was seen as a significant milestone toward securing the second tranche of the IMF loan, boosting confidence in Sri Lanka’s economic recovery.

Sri Lanka has been grappling with its most severe financial crisis in over seven decades, leading to the acquisition of a nearly USD 3 billion bailout package in March 2023. The IMF approved a 48-month arrangement of SDR 2.286 billion (USD 2.9 billion) through the EFF to assist Sri Lanka in navigating its economic crisis.

The primary objectives of the loan program are to restore Sri Lanka’s macroeconomic stability, ensure debt sustainability, protect the vulnerable population from economic impacts, stabilize the financial sector, and strengthen governance and growth prospects. It also opens doors for Sri Lanka to access up to USD 7 billion in financing from international financial institutions (IFIs) and multilateral organizations.

Under the IMF program, Sri Lanka has set ambitious targets for the next decade, aiming to restructure its debt and reduce the debt-to-GDP ratio from the current 120% to about 95% by 2032. However, Sri Lanka must conclude discussions with key bilateral creditors like Japan, China, and India before proceeding with its debt restructuring plans.